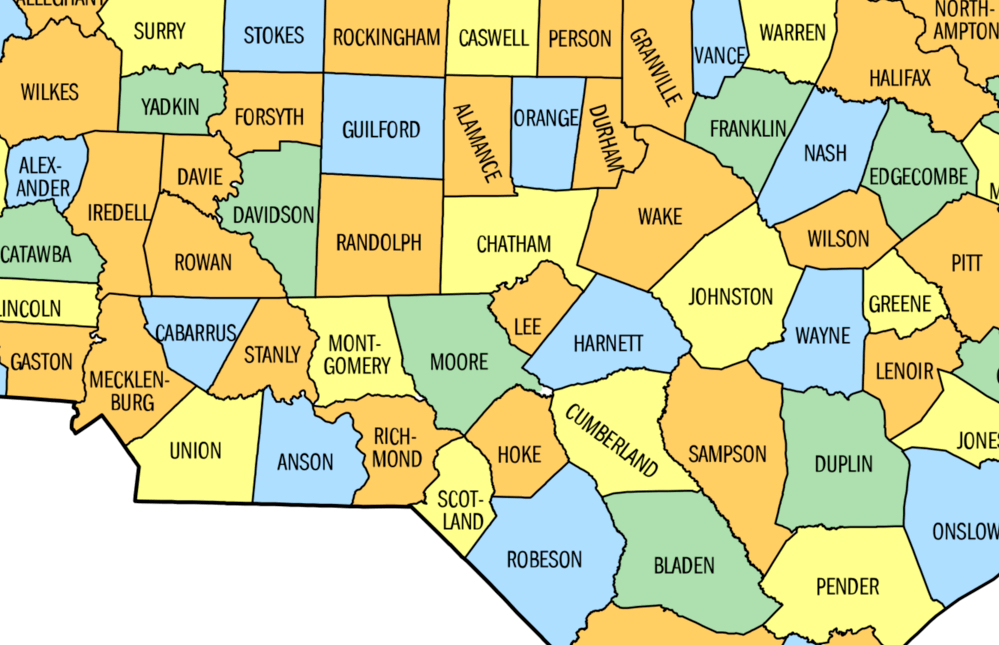

After determining if the decedent had a valid will, as discussed here, the next step is confirming if an estate file has been opened and, if so, that filings have been submitted in the appropriate county. Estate files are opened and probated in the county where the decedent was living at the time of death. In many cases, probate in the decedent’s home county is sufficient to transfer assets. However, if the decedent owned real property in a different county, additional steps will need to be taken to effectively pass title and for the property to be sold.

For any transfer or sale of real property to be valid against claims of creditors, the decedent owner’s will must be probated or filed in the county where the property is located. For example, if the decedent was a resident of Forsyth County, but the property being sold is in Davidson County, there must be a filing in Davidson County. Thankfully, it is not necessary to fully probate the decedent’s estate in every county where property was owned. Instead, the filing is typically done through a process known as ancillary probate. This must be done even if the original estate file has already been closed! This can be done by filing a certified copy of the will, Certificate of Probate, and Letters Testamentary in the county where the property is located. The same rule applies for out-of-state decedents who owned property in North Carolina.

Confirming the existence of a will (or not) and that any estate filings have taken place in the appropriate county are only the first two steps. Once that information is confirmed, it is possible to determine who will be required to sign any documents necessary for closing. That determination will be explored further in subsequent posts!

Revolution Law Group is located in Greensboro, NC, and serves individuals and small businesses throughout the Triad and surrounding areas. To contact us please visit Revolution.law or call 336-333-7907.

The information included here is for informational purposes only, is not exhaustive of all considerations when creating documents, is not intended to be legal advice, and should not be relied upon for that purpose. We strongly recommend you consult with an attorney and do not attempt to create your own documents.